Benefits of the leasing programme

- Monthly rentals are tax deductible.

- VAT is paid on the monthly rentals and not as the lump sum of outright vehicle purchase price.

- Varied lease durations, hence client pays only for the portion of the vehicle that they actually use.

- Vehicle treated as an off balance sheet item, hence healthier balance sheet.

- Total Maintenance function remains our responsibility, allowing the firm to concentrate on core business.

- Tailored Maintenance solutions/packages to suit unique customer requirements.

- No down payment required.

- Insurance premium paid on monthly basis, rather than as an annual lump sum.

- Option of getting a new vehicle at the end of the lease period, through extension of the lease contract.

- Lease period can be extended where required.

- Car disposal at the end of the lease remains our responsibility.

- Given priority of buying the used vehicle at the end of the lease period if interested.

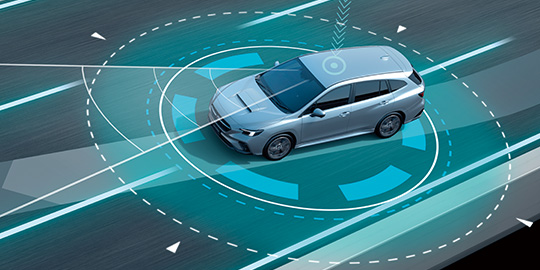

- Comprehensive fleet management module is offered, thus assisting clients monitor /control usage and cost.